2024 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours (part two)

From where they’re buying groceries to what’s in their basket, their biggest pet peeves at the store and much more, we teamed up with the research group at EnsembleIQ (Canadian Grocer’s parent) to get a handle on how Canadians size up the grocery shopping experience. Shoppers all across the country were surveyed to bring you our fourth-annual 2024 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours.

Below are some highlights from the study. Read part one here.

Bricks rule, but clicks grow

While physical stores continue to be the preferred place for procuring groceries, with 98% of survey respondents saying they’ve shopped in-store in the past month (edging up slightly from 97% last year), online options are also seeing gains. Contactless delivery, for instance, was used by 17% of shoppers in the past month (up 4%), while in-store pickup was used by 14% (also up 4%). Although more shoppers are purchasing groceries online, they’re not all happy with the experience.

Our survey revealed just 45% of shoppers were completely satisfied with the online experience, a drop of 8% over last year; another 45% are somewhat satisfied, while 10% are not at all satisfied. The top reasons for dissatisfaction include expensive fees, out-of-stocks, product substitutions and product quality. Survey respondents also complained of “forced tipping without the option to adjust,” “messy websites” that were difficult to navigate, and not being able to use coupons or price matching promotions when shopping online. Looking ahead, we asked shoppers to anticipate how they think they’ll be shopping a year from now. Generally, they said they expect to follow the same grocery shopping patterns, although 22% said they expect to shop more in-store and 7% indicated they’d be opting more for contactless delivery of their groceries.

Making a list

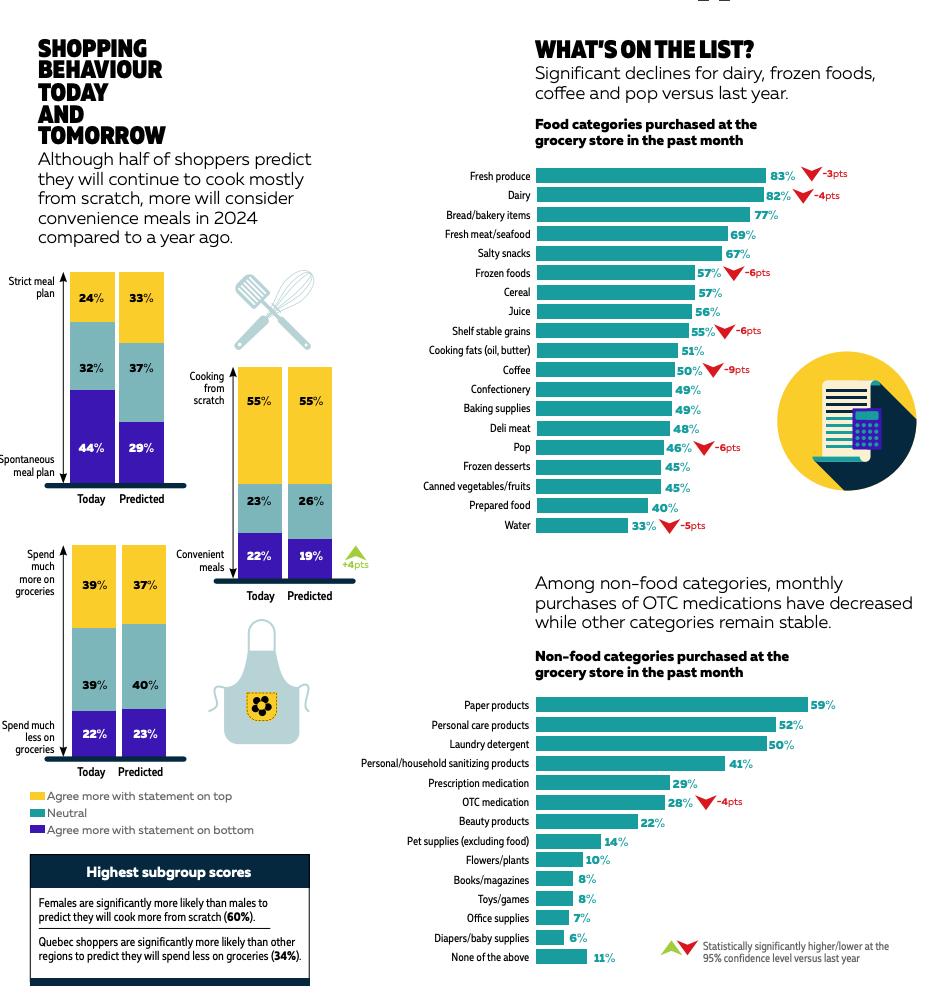

Perhaps to keep themselves on track and on budget, most shoppers head to the grocery store armed with a list. In fact, 17% make a list and stick to it, while 64% have a list, but go off-list, purchasing additional items. Another 17% don’t make a list, but have a rough idea of what they’ll purchase at the store, and 2% of shoppers completely wing it, deciding what to purchase in-aisle.

Despite inflation, shoppers said they spent, on average, $114 on their most recent grocery trip, consistent with last year. However, eight in 10 shoppers said they have changed their shopping behaviour in some way to cope with the sting of rising food prices. Among the top strategies shoppers are employing include: buying items on reduced price/clearance (50%), fewer impulse purchases (44%), buying less groceries overall (37%) and shopping more frequently at discount grocery stores (31%). Meanwhile, just 18% said they had not changed their shopping behaviours in any way.

Purchasing private-label products is another way shoppers can potentially stretch their dollars and 89% of shoppers surveyed said they purchase these items always or sometimes. Saving money is one motivation (for 71% of shoppers), but 48% believe the quality of private-label products to be similar to name brands, while 18% (up 4%) think store brands are of better quality than the name brand equivalent—another opportunity for grocers as they expand their private-label programs to better manage operational costs.

So, what’s in the basket? Despite the average spend at grocery remaining consistent, there are some shifts when it comes to what’s ending up in shoppers’ carts in the past month. The survey revealed declines in fresh produce (83% versus 86% last year), dairy (82% versus 86%), frozen foods (57% versus 63%) and coffee (50% versus 59%). Interestingly, affordable luxuries like confectionery that enjoyed big gains last year saw a slight decline among survey respondents this year. Among non-edible categories purchased at grocery stores, top items such as paper, personal care products and laundry detergent remain stable; however, overthe-counter medication has dropped significantly in monthly purchase incidence (28% versus 32% last year).

When we asked shoppers if there were additional products or services they’d like their primary store to offer, most (71%) indicated no, while 29% (up from 22% last year) said they would like to see some extras. These shoppers listed alcohol, a pharmacy, an in-store restaurant or a café as items they’d like to see offered at their grocery store.

An appetite for prepared foods

When restaurants were shuttered during the pandemic, consumers turned to grocers for prepared meals. Nearly four years on, cost-conscious consumers and those with busy routines are still hungry for grocery store prepared meals. In fact, our survey found that more shoppers (66% versus 63% last year) are purchasing prepared food at the grocery store and they’re doing so, on average, twice a month. Although many grocers have upped their game in this crucial area, there’s still work to do to woo the nearly one-third of shoppers who are not currently purchasing prepared foods. When we asked these shoppers why they’re not buying these foods, for 51% it came down to price – they think they’re too expensive. Among the other reasons: 44% prefer not to purchase prepared food at a grocery store/prefer to cook at home, 31% said they didn’t plan to purchase prepared food when they went to the store, 13% (up 6%) said the food on offer didn’t look appetizing, while 9% said there weren’t any healthy food options.

Entrees (pizza, fried chicken, rotisserie, sushi, etc.) were purchased by 62% of shoppers, making them, by far, the most popular offering. From a demographic standpoint, boomers (72%) are significantly more likely than all other age groups to buy prepared entrees. Other popular items include baked goods (prepared in store), which were purchased by 30% of shoppers, and prepared hot sides, which were purchased by 21%. It’s worth mentioning that only 53% of prepared food shoppers said they were completely satisfied with their purchase. This is a 10% drop from last year, suggesting there’s an opportunity for grocers to improve their offerings and deliver on price, quality, freshness and taste – the most important considerations for shoppers in this category.

While dinner remains the most popular time for prepared food purchases, lunch is making gains, with 24% of shoppers (up 5%) buying prepared food during this daypart. Interestingly, this number is significantly higher in Quebec, where 37% of shoppers are making lunchtime purchases, a potential growth area for grocers. And although 74% of shoppers are eating purchased prepared food at home, there continues to be a shift to ou-tof-home consumption, with 26% of shoppers (up from 20% last year) either eating their purchases in the store, at work, in their car or at school.

Health and sustainability

The number of shoppers who identified as “health conscious” dropped to 68% this year, from 73% the last two years. There are notable regional and generational differences to note, however, as 78% of Quebeckers identify as health conscious, along with 73% of boomers and 69% of gen Xers. The good news for grocers is that 90% of shoppers expressed some level of satisfaction with the selection of healthy/better-for-you options available at their grocery store, which has remained stable. When asked specifically about what health-focused offerings at grocery they deemed valuable, an in-store pharmacy was valuable to 29% of shoppers, healthy recipe cards at shelf (21%), free in-store health magazine (17%), health care app, healthy cooking classes (each of value to 11% of shoppers) and in-store dietitian (10%).

When it comes to the health of the planet, shoppers continue to want grocers to demonstrate a commitment to sustainability. For 84% of shoppers donating food instead of tossing it out is important, while 80% said locally sourced produce/animal products was important and 76% said it was important for grocers to show progress towards zero waste. And while 60% of shoppers said they are at least somewhat likely to switch to another store if it was more committed to sustainability, 45% of these potential switchers said they’d be willing to pay a bit more for a more sustainable store, while 41% said they would not. For the latter, perhaps it’s a sign of the times; they want to shop sustainably, but higher prices aren’t an option.

This article first appeared in Canadian Grocer’s February 2024 issue.

Overview & Methodology

- Survey sample: 1,000 grocery shoppers

- Respondents were required to be age 18+, reside in Canada, shop at grocery stores at least once a month and are the primary or shared decision-maker for household grocery shopping

- Quotas were established by province/ territory to accurately represent the population distribution of Canada