Fresh insights: Canadian Grocer’s 2025 Produce Operations Survey

With ongoing issues and current U.S. tariff threats expected to prompt further price hikes in grocery, the outlook could be quite bleak for produce departments across the country. But, as the Canadian Grocer Produce Operations Survey reveals, there is still hope and opportunity amidst these challenging times. In fact, when it comes to produce, some industry experts and retailers are optimistic about the year ahead, provided grocers can balance customer needs and preferences with turbulent market conditions. The consensus is that being agile and innovative will be more crucial this year than ever.

Here’s a look at some key challenges and opportunities as revealed through our sixth-annual survey, plus insights on what will make the pain points more tolerable in 2025 and beyond.

Produce department challenges?

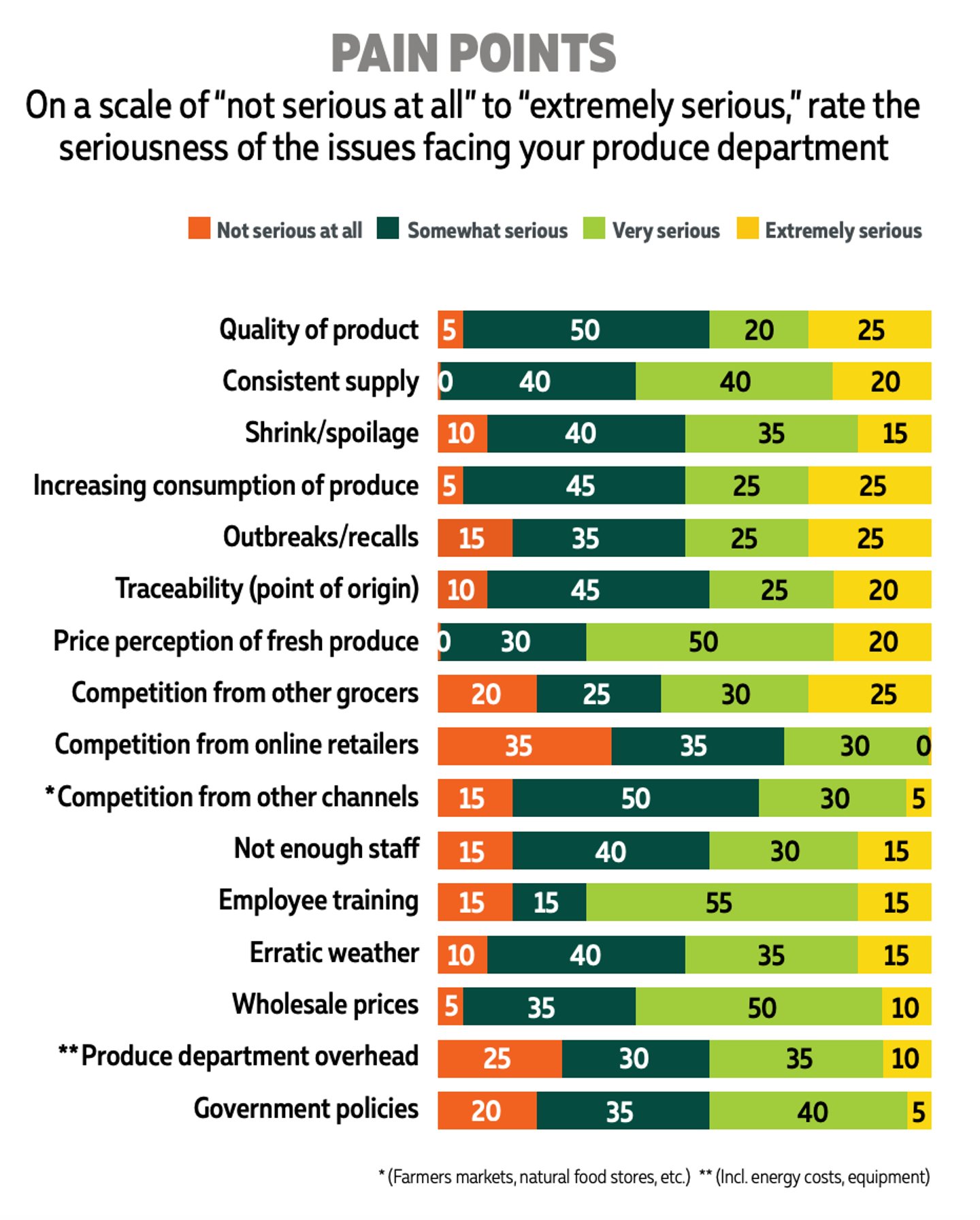

Overall, the produce department was a growth leader in 2024, according to the Food Industry Association’s (FMI) just released Power of Produce 2025 report, and most Canadian Grocer survey respondents (67%) expect same-store produce sales will continue to increase this year. But, price perception of fresh produce and wholesale pricing are “extremely” or “very” serious concerns for most Canadian grocers surveyed, along with inconsistent quality of product. “Our most serious challenge is the quality of product we are receiving from our suppliers,” said one respondent. “We have seen a significant decline in product quality over the last two years.”

Joe D’Addario, CEO of Nature’s Emporium, says weather-related disruptions and global supply chain challenges continue to impact produce availability. “This year, unpredictable growing conditions, particularly in key U.S. regions, have made it more difficult to ensure consistency,” he says. This supply chain volatility combined with inflation-driven price sensitivity is necessitating greater agility in sourcing and merchandising. “While we prioritize high-quality organic and local produce, we must balance that with competitive pricing and strong value messaging,” he says.

READ: Growth and challenges in the organics market

Also topping the list of concerns in Canadian produce departments these days is labour shortages and employee training. “Produce takes a long time to learn and things are always changing with the seasons, so there are a lot of decisions to be made every day just stocking the product,” says Will Willemsen, founder and owner of Sunripe markets in Ontario. With many of his long-time employees now retiring, he is expecting it will be particularly hard to replace them. “I think the No. 1 challenge is always finding longterm, reliable staff.”

Willemsen says having a good profit-sharing plan in place has been a good way to retain staff over the years, as has providing opportunities for newcomers to Canada seeking consistent work. “My daughter ensures we do a lot of fun social events for staff, too, be it pie-eating contests or regular potlucks in the lunchroom for different occasions,” he says.

What’s the impact of trade wars on produce?

At the time this survey was fielded, the U.S. threat of 25% tariffs on imports from Canada and Mexico was still uncertain, but some Canadian grocers surveyed still voiced concern about its potential impact on food costs and future supply and demand.

Ron Lemaire, president of Ottawa-based Canadian Produce Marketing Association (CPMA), says grocers can expect 2025 to be an especially politically driven year in Canada and globally. While we have a dynamic domestic produce industry here already, he points out that 75% of fruits and vegetables purchased by Canadians are still being imported. “We also grow enough to be able to service the U.S. market, which enables us to continually service Canada at the right price and volumes necessary to meet demand,” he adds.

READ: Tariffs a hot topic at CPMA 2025

Not only will a new tariff framework mean a change in trading patterns that could affect supply and demand, but Lemaire warns it could stall investment in capital growth and innovation at a time when the food industry is starting to finally emerge from the challenges wrought by the pandemic.

From a fresh fruit and vegetable perspective, Lemaire says Canada has a solid track record of working with more than 150 countries to bring in commodities to meet the country’s cultural mosaic of preferences. But, ramping up volume to access production that may already be earmarked for another market could be challenging. “If we are going to grab some of that pie, it’s going to cost more, and then that’s assuming there are no weather issues that could change production and purchasing patterns,” he explains.

In the short-term, Lemaire says planning is key to ensure grocers have the right contingency plans in place to be able to diversify purchasing strategies from multiple countries. Longer term, he says it’s important to remember the U.S. is still one of Canada’s most valuable trading partners due to proximity. “A lot of the U.S. growers, packers and shippers are not in favour of these trade strategies,” he says. “We need to make sure that we continue working with these partners, because when this is all over that five-day window of importing products will still be there.”

Where’s the opportunity in challenging times?

Meanwhile, grocers such as Freson Bros., which has 16 locations across Alberta, are finding new ways to drive local produce production year-round. Every fall for the last few years, the grocer has set aside time to meet with different producers in the province to determine ways to fill gaps in home-grown produce offerings.

The grocer is currently working with a producer crafting a new romaine heart product that is expected to launch in Freson Bros. stores by the end of March.

“There could not be a better time to launch something like this,” says director of produce Daniel Pazder, noting that his team has also collaborated on a Canadian strawberry program in years prior. “There are a lot of field growers we work with throughout the summer, too.”

READ: Inside Haven Greens, 'the Lamborghini' of greenhouses

For Eastern Canada, the Ontario Food Terminal continues to be a coveted place to find a well-stocked variety of fresh produce at competitive prices. “They’re already sourcing from all over the world and have the transportation ability to bring product in, so I think we’re going to really benefit from their expertise now,” says Giancarlo Trimarchi, president of Vince’s Market in Ontario.

As food prices continue to creep up, he says ensuring consistency in quality is also key. “From an operating standpoint, it’s making sure the produce we’re bringing in and selling is of the right quality and at the right price point,” he says.

In addition to diversifying trading sources, offering quality products and putting greater focus on Canadian-grown produce this year, our Produce Operations Survey respondents cited added value, convenience and creative merchandising as some of the biggest opportunities to grow sales in their produce departments in the next six months.

“This year, we sold more seeded pomegranate than whole, showing us that some customers don’t know [how to] or want to clean a pomegranate and are willing to pay more for the pre-seeded kind,” says Trimarchi. “There is still more opportunity in the right kind of valueadded produce programs and it’s on us to identify those for the customers and give them the offerings.”

What’s influencing produce preferences?

FMI’s Power of Produce report shows 40% of shoppers are putting effort into making healthy and nutritious food choices. Rick Stein, vice-president, fresh foods at FMI, says grocers can leverage science-based nutrition information, including MyPlate (or Canada’s Food Guide), to educate shoppers about fruit and vegetable portion sizes and offer recipes and cooking preparation techniques to help shoppers meet their health and wellbeing needs. “It’s really about being a resource for produce shoppers with meal ideas and solutions,” he says.

The report also revealed nearly half of shoppers are discovering new ways on social media to enjoy or prepare produce. Frozen grapes that started trending on TikTok several years ago are one such example, with consumers still showcasing flavours to coat them in. “Food retailers can either react to social media trends by monitoring and fine tuning their merchandising strategy or lean into social media trends by creating new twists with education about unique produce offerings, recipes, cooking techniques and more,” says Stein.

READ: What’s new in specialty produce?

Sunripe’s Willemsen, who has been in the industry for more than 40 years, says it has been amazing to witness new trends in produce year after year. “I remember when all the watermelons were seeded and pineapples were white,” he says. “Consumers want fresh, new products now and so there is constant innovation happening in produce all the time that makes it fun for them and fun for me to be in the business.”

Where are grocers investing next?

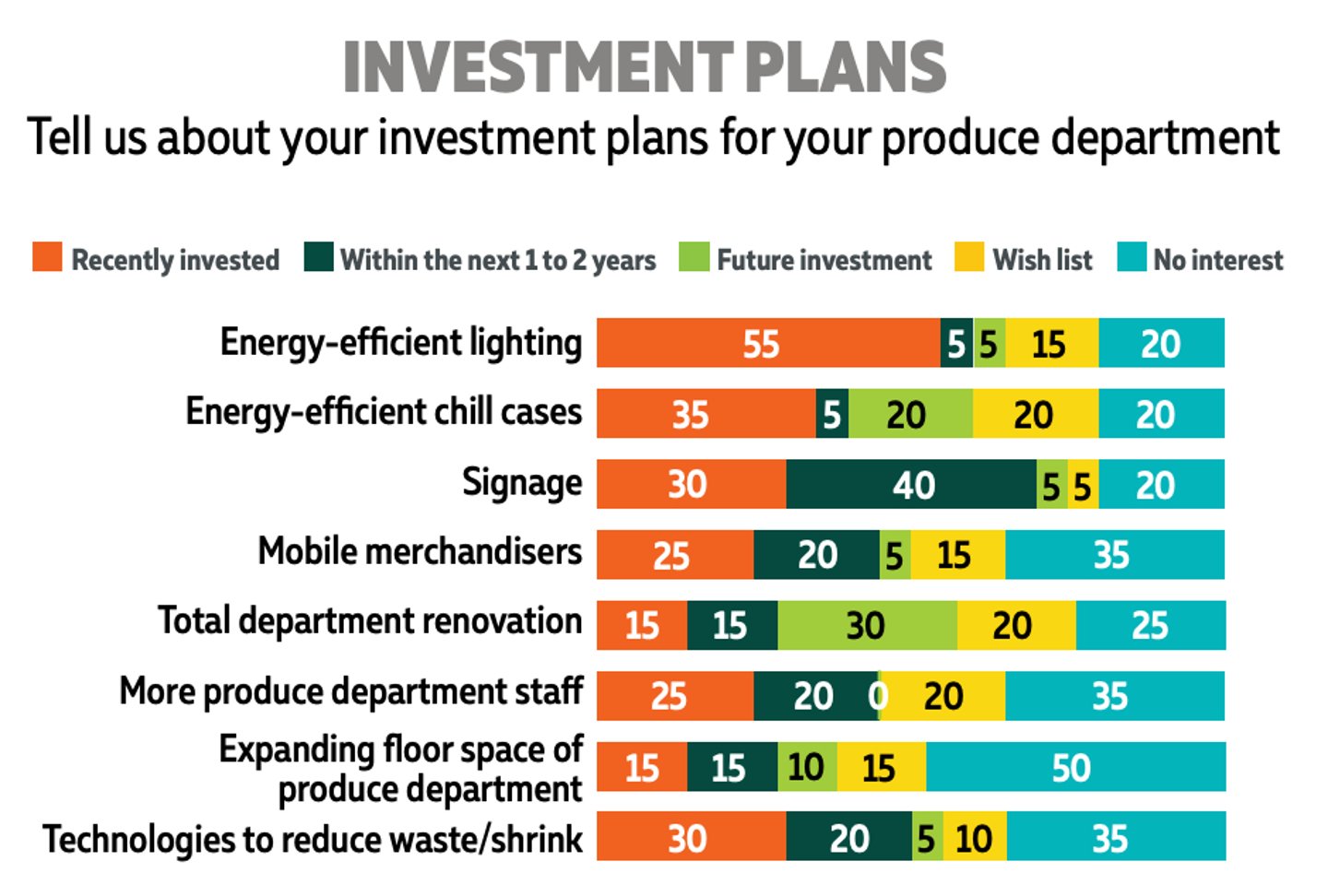

According to our Produce Operations Survey, more than half of respondents have recently invested in energy-efficient lighting and 35% have opted for more energy-efficient chill cases in their produce departments. Improving signage in produce is also on grocers’ radars, with 30% investing in signage and 40% planning to do so within the next one to two years.

Longo’s vice-president, merchandising Joe Fusco says his company continues to make key investments in signage and merchandising in produce departments to ensure guests are informed when making purchases. “This includes clear labelling of fair trade and organic items, as well as our locally grown products and the farms they come from,” he says. Longo’s is also working to drive greater awareness of Canadian products in-store through shelf tags, flyers, digital advertising and emails.

READ: Five ways to give your produce department a boost

More and more, Canadian grocers are looking to technology to improve efficiencies in their produce departments, whether that be to reduce shrinkage or for better forecasting of supply.

Fusco says technology has a big role to play in Longo’s 41 stores. “It makes our inventory tracking and forecasting more efficient, which is significant in supporting our sustainability goals to minimize waste and divert waste from landfills,” he says. “We expect the tools we use to continue to increase efficiencies and bring greater value to our guests when they shop with us.”

FMI’s Stein says food retailers will continue to leverage technology in produce for fresh inventory planning, online ordering, product traceability and even customer service. As staffing and training continue to challenge retailers, he says many are finding technology solutions that create efficiencies and allow staff to offer enhanced customer service.

Online produce sales are another area expected to keep growing. “We know from the research FMI conducted with [global marketing research company] NIQ that 55% of consumers make online purchases directly via social media or live-streaming platforms,” says Stein. “As shoppers continue to value convenience and seek technology solutions, we are likely to see online produce sales increase.”

Grocers can also expect artificial intelligence (AI) to become more prominent in Canada’s produce sector, says CPMA’s Lemaire. “In food, we still don’t know how best to leverage AI … but, it is the new horizon,” he says. “The simplest way is to use AI to improve efficiencies, but the potential for forecasting is something we need to leverage more.”

This article was first published in Canadian Grocer’s March/April 2025 issue.